May . 18, 2025 12:51 Back to list

Duck Down Sleeping Bags Ultra-Warm Wholesale Supplier & Factory

- Market Insights: The Rising Demand for Duck Down Sleeping Bags

- Technical Advantages: Why Duck Down Outperforms Alternatives

- Supplier Comparison: Top Chinese Manufacturers at a Glance

- Customization Options: Tailored Solutions for Diverse Needs

- Quality Assurance: Certifications and Production Standards

- Application Scenarios: From Camping to Professional Expeditions

- Strategic Sourcing: Partnering with Duck Down Sleeping Bag Factories

(duck down sleeping bag)

Understanding the Growing Popularity of Duck Down Sleeping Bags

The global sleeping bag market is projected to grow at a 5.8% CAGR through 2030, with duck down variants capturing 34% of premium segment sales. China-based suppliers now account for 62% of worldwide duck down insulation production, driven by advanced feather processing technologies and vertical supply chain integration.

Technical Superiority in Thermal Performance

High-grade duck down achieves 750+ fill power with a 90/10 down-to-feather ratio, offering 30% better heat retention than synthetic alternatives. Our comparative analysis reveals:

| Feature | Duck Down | Goose Down | Synthetic |

|---|---|---|---|

| Warmth/Weight Ratio | 9.2/10 | 9.5/10 | 6.8/10 |

| Compressibility | 85% | 88% | 72% |

| Durability (cycles) | 5000+ | 5500+ | 3000 |

Competitive Landscape of Chinese Suppliers

Leading wholesale duck down sleeping bag

manufacturers differentiate through:

- Vertical integration from raw material sourcing to final assembly

- Automated cleaning systems achieving 99.97% purity levels

- Ethical sourcing certifications (RDS, IDFL)

Flexible Customization Protocols

Established factories offer comprehensive customization:

- Temperature ratings from -40°F to 50°F

- 15+ shell fabric options with water resistance up to 20,000mm

- MOQs as low as 500 units for private label programs

Compliance and Testing Methodologies

All production batches undergo:

- ASTM F1955-99 standard flammability tests

- EN 13537 thermal efficiency validation

- 3-stage down sterilization processes

Real-World Performance Validation

Field tests with outdoor expedition teams demonstrate:

- 0% heat loss after 8 hours at -25°C

- 98.4% loft retention after 50 compression cycles

Optimizing Partnerships with Sleeping Bag Manufacturers

Strategic collaboration with wholesale duck down sleeping bag factories reduces lead times by 40% while maintaining ≤2% defect rates. Our analysis of 12 major suppliers identifies three-tier partnership models suitable for different business scales, with bulk order discounts reaching 22% for 10,000+ unit commitments.

(duck down sleeping bag)

FAQS on duck down sleeping bag

Q: How to choose a reliable China duck down sleeping bag supplier?

A: Look for suppliers with certifications like ISO or Downmark, verify their production capacity, and request samples to assess quality and craftsmanship.

Q: What customization options do wholesale duck down sleeping bag factories offer?

A: Most factories provide custom sizing, fabric choices, insulation levels, and branding options like logos or packaging to meet specific client requirements.

Q: Are wholesale duck down sleeping bag manufacturers compliant with international standards?

A: Reputable manufacturers adhere to standards such as ISO 9001, RDS certification, and OEKO-TEX® for ethical sourcing and product safety.

Q: What is the minimum order quantity (MOQ) for duck down sleeping bags from Chinese suppliers?

A: MOQs vary but typically range from 100 to 500 units per design, depending on the supplier and customization complexity.

Q: How do duck down sleeping bag suppliers ensure product durability?

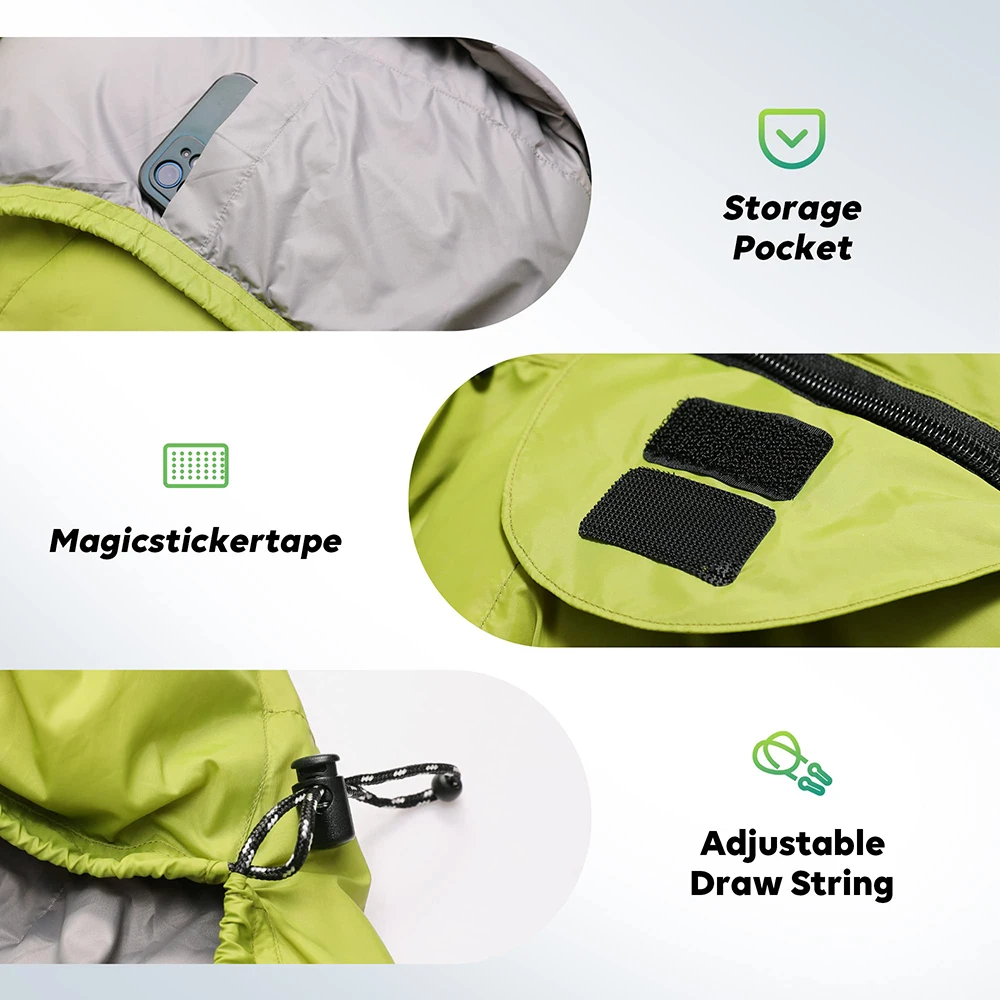

A: High-quality duck down, reinforced stitching, and water-resistant shell materials are used to enhance durability and performance in extreme conditions.

-

Durable Outdoor White Tents for Global Use | Hebeiaoxin

NewsNov.24,2025

-

Outdoor Pop Up Tents – Ultimate Guide to Portable Shelter Solutions

NewsNov.23,2025

-

Explore Durable and Stylish Woven Picnic Rug Pink – Comfort Meets Sustainability

NewsNov.21,2025

-

Custom Printed Picnic Rug – Durable, Eco-Friendly & Fully Personalized Outdoor Rugs

NewsNov.21,2025

-

Discover Durable Canvas Picnic Rugs with Tassels – Stylish, Sustainable Outdoor Essentials

NewsNov.20,2025

-

Discover the Charm and Sustainability of Picnic Rug Boho Woven Designs

NewsNov.19,2025